Did you miss our previous posts in this series? Start from the beginning with part 1.

Welcome to the fourth and final installment of our growth series. We’ve been exploring the various ways a company can structure their portfolio as they grow and evolve. So far, we’ve covered the house of brands and the branded house, which follow simple sets of rules for portfolio organization. However, some companies require a more complex system that pull principles from each of these structures. These are known as blended houses.

In a blended house, some products or sub-brands share the company brand, while others create more separation by having their own distinct brand. This structure requires higher development and maintenance costs, but the payoff is the ability to expand market share and appeal to different target audiences. It does so by leveraging the credibility and strength of the corporate brand in the appropriate markets while creating distinction with new segments.

Large retail brands, in particular, tend to use this structure to grow beyond their roots.

Amazon: Expanding Reach

In the nearly three decades since its founding, Amazon has become a go-to online retailer for books, clothes, and everything in between. However, the expansion in what the company sells goes beyond just what is available through amazon.com.

Over the years, Amazon has acquired many existing retailers such as Zappos, Shopbop, and Audible. It has also expanded its reach into new markets such as grocery, security, pharmacy, and entertainment with the acquisition of Whole Foods Market, Ring, PillPack and, most recently, MGM. In the meantime, Amazon has also continued to grow its in-house offerings, moving into music, devices, and more.

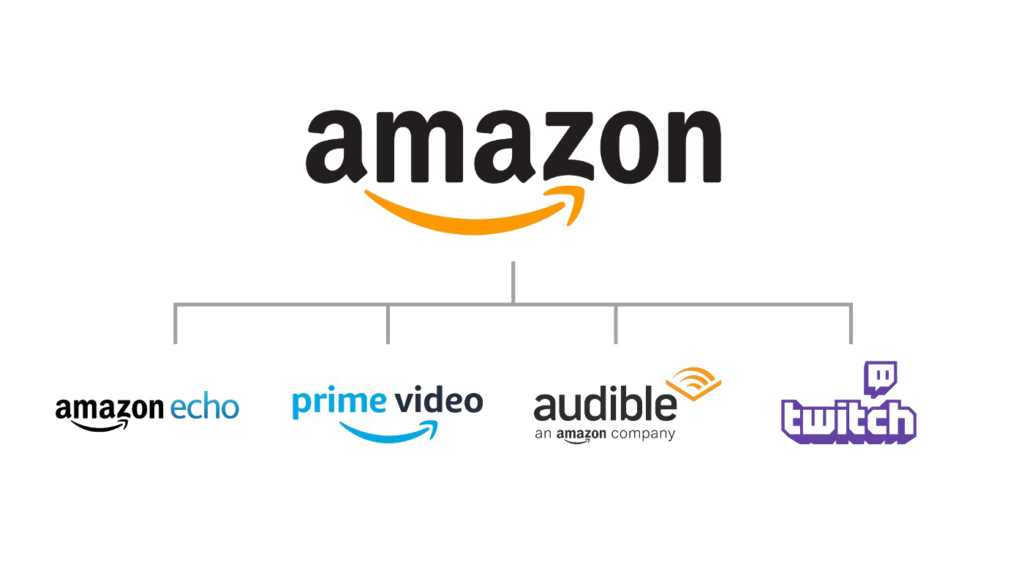

From a branding perspective, the two strategies of building innovations in-house and acquiring existing companies created the opportunity to leverage a blended house. As Amazon rolls many acquired brands into its portfolio, it retains the original brands to hold on to equity and audiences. Alternatively, it has continued to grow the Amazon corporate brand with offerings such as Amazon Music and Amazon Fresh.

Walmart: Beyond Brick and Mortar

Another large retailer that has utilized the blended house approach is Walmart. Opting to stay focused in retail, Walmart has expanded its brand and reach with various storefronts over the years including the corporate-branded Walmart Supercenter, Walmart Neighborhood Market, and the sub-brand Sam’s Club.

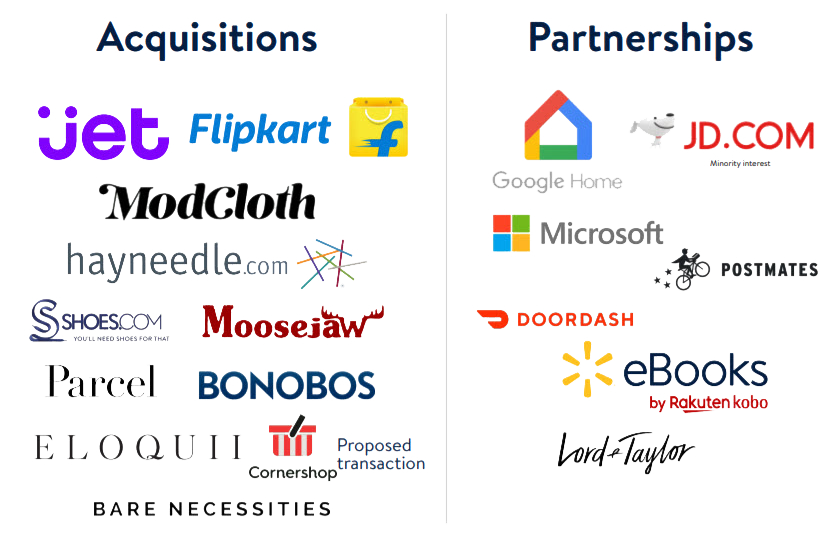

In more recent years, they have also expanded beyond stores to ecommerce, continuing to build on their blended house. In addition to operating Walmart.com, the company owns and operates multiple web-based brands that many may not know are part of this retail giant.

Moosejaw, Bonobos, and Eloquii are all fashion brands acquired by the company between 2017 and 2018. Since that time, they have maintained their original brands and online spaces without linking to their parent company. This intentional separation helps the sub-brands to appeal to younger audiences as well as offer clothes at a more premium price point. The same is true of Art.com, which was also acquired by Walmart in 2018.

These varying strategies of maintaining a clear link between all the brands within a blended house, or creating separation when appropriate, is how many brands support growth.

______________________________________________________________________

At BrandJuice, we are a partner in helping you consider all angles of a potential change or evolution of portfolio strategy. If you are in a time of growth, explore our strategy offerings to see how we can help you create a portfolio structure that will serve you well into the future.