The DRAFT analysis includes portfolios from peers as well as some of the largest investment firms in the world. DRAFT will show you how much you’re spending each year for your investments, and how much it will cost you over time. Armed with the knowledge DRAFT supplies, users can start analyzing their finances, moving money towards less expensive investment vehicles. We took some time to chat with co-founder Brad Lawler on the SXSW experience and his predictions for disruption within the category.

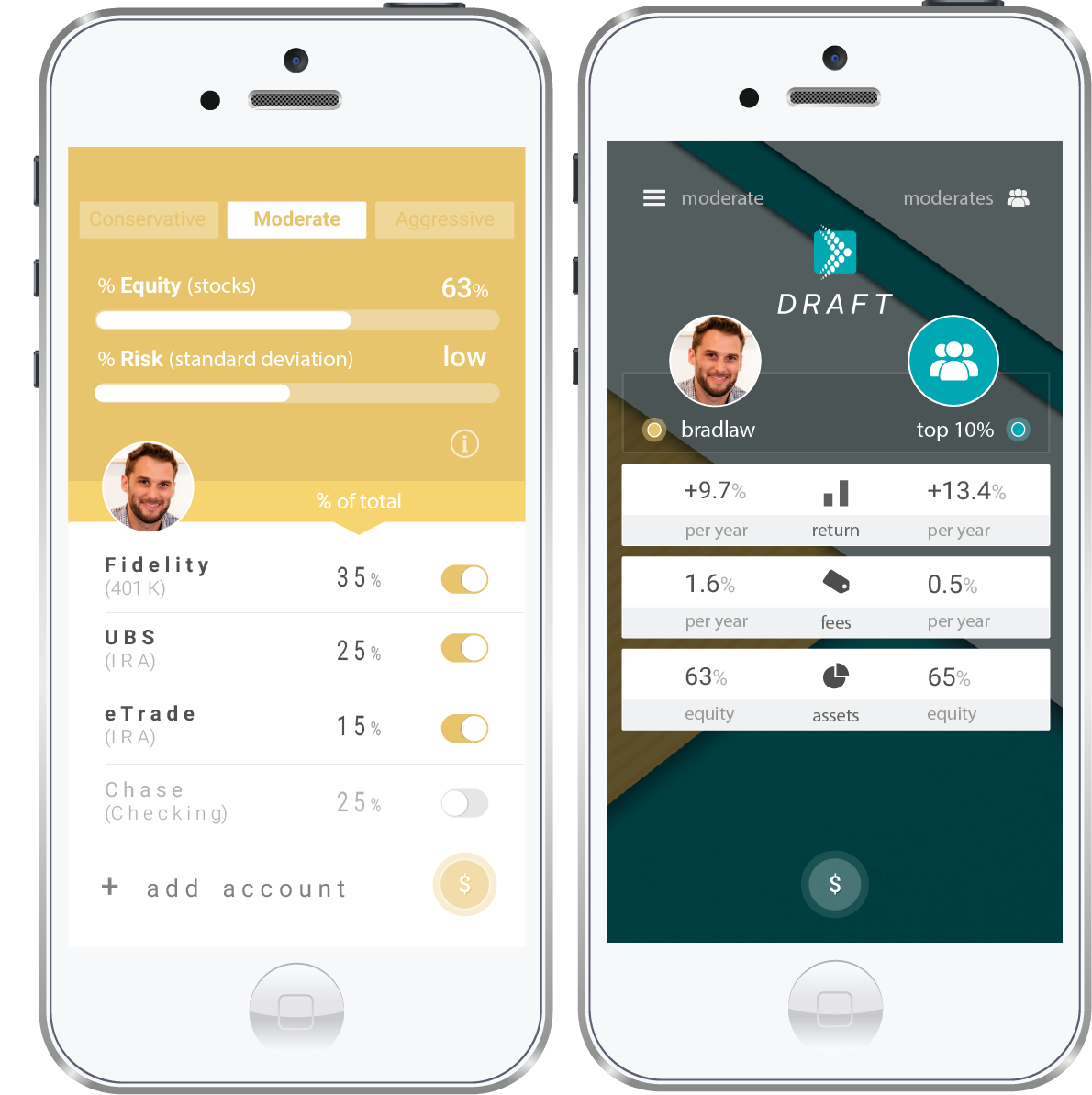

DRAFT app is one of many fast growing tech companies in the Austin area. Named one of the Top 50 Austin Startups To Watch, and an official selection in SXSW’s Startup Spotlight, DRAFT aims to be the premier resource for managing and optimizing investments. And it all starts with a personalized, easy-to-use mobile app that is as beautiful as it is advanced. DRAFT gives you a complete financial portrait that begins with Investment Type (Conservative, Moderate, Aggressive). Users can explore an in-depth looks at different financial factors including Historical Return, Asset Allocation, and Annual Investment Fees.

– What innovations do you think will impact your industry in the next year ahead?

I believe the application of machine learning within consumer finance will have the largest impact on the FinTech industry in the next year. Smart algorithms that help individuals understand their own financial and investment habits compared to others will have a huge effect on behavior and will help us all make better decisions.

– Who’s disrupting your category?

A new class of financial adviser is developing which provides investment management through online tools with minimal human intervention. These new “robo-advisors” are able to keep an investor balanced across a variety of asset classes for a fraction of the cost of a human advisor. This shift to automated, online management has and will continue to bring investment costs down across the industry.

– What should every innovator know?

The idea is the easy part. If your idea is truly novel, you will face incredible hurdles combining or creating new technologies from scratch. There is no blueprint for innovation. Before you take on this monumental task, make sure to validate the idea with a much larger sample group than you think is needed. You don’t know what your audience really wants or needs until you talk to them.

– What makes your product especially innovative?

DRAFT builds on the data aggregation benefit of a “robo-advisor” by helping investors understand how the performance, asset allocation and annual fees of their current strategy compare to that of their peers. DRAFT creates a relevant benchmark by first categorizing an investor’s portfolio as conservative, moderate or aggressive and then creates a custom benchmark built from an average of top performers in their category. This allows investors to lower fees and fill allocation gaps within their current strategy without having to transfer money. This approach uses technology to enable an investor’s understanding and potential instead of replace it.

– What’s most impressive to you at SXSW so far?

The most impressive thing at this year’s SXSW for me as been the rapid emergence of FinTech (Financial Technology) at the SXSW conference, in Austin, and across the country. Our data aggregator partner, Yodlee, hosted the exact same FinTech party at the exact same place during last year’s conference. The attendance was underwhelming last year. This year, however, the place was packed with innovators looking to leverage Yodlee’s aggregation tool to build financial payment, loan, and investment products that will continue to disrupt a flawed industry.